There have been several high-profile announcements in early 2023 indicating the rapid growth and excitement around the emerging Carbon Capture and Storage (CCS) industry. Spirit Energy’s aim to repurpose offshore gas fields, Petronas’s subsidiary MISC, Eni’s Hynet project in the UK, and Energean and Shell in Egypt to name a few. The NSTA has also announced a new dedicated Carbon transportation and storage team in response to the rising interest. And there is good reason for all the buzz about CCS too.

What is Carbon Capture and Storage (CCS)?

Carbon capture and storage (CCS) is a process where carbon dioxide (CO2) from industrial sources is separated, treated, and then injected into a subsurface reservoir for long-term storage.

CCS is often seen as the only credible solution to offsetting CO2 emissions in industrial sectors such as steel, cement, aluminium, and chemicals. Unlike replacing internal combustion engines, materials like cement and steel have no readily available replacement and will continue to form the basis of our towns and cities for several decades to come. These projects are a welcome change to the usual backlash faced by subsurface companies when a new project begins.

Can CCS be profitable?

One troubling concern for all new CCS projects however is – how can they be made commercially viable? Right now, as the industry gets going, funds such as the Carbon Capture and Storage Infrastructure Fund are essential, but this as a single source of funding is not sustainable to continue to make CCS commercially viable in the long term.

So how can we reduce the cost of a CCS project? Can using data strategically be the answer to make projects commercially viable now?

“The ability of our highly-skilled industry to contribute positively to environmental concerns and create “thousands of highly skilled green jobs” is something to be celebrated.” (EnergyVoice)

I believe it’s possible

For my 2 cents, I’m going to say ‘yes’. I believe if we can use data more strategically, it will definitely reduce costs and improve the commerciality of CCS projects. Ok, so I accept that as a geoscientist who has made the move into the data management world, I would say that…

Here are 3 reasons why I think this is the case.

1. Drilling new wells is expensive – it’s much cheaper to repurpose existing data

A deepwater North Sea well could set you back USD 100M. These costs may be commercial for extracting a resource that is currently fetching over USD 80 per barrel. However, even with certain industrial sectors eager to find a solution to store their excess carbon, the hefty (and rising) drilling costs are not going to be acceptable to an industry looking to offload a bi-product.

But fortunately, lots of wells have already been drilled so if we can easily repurpose their data, we don’t need to pay to drill new ones. Over 8000 in the UKCS alone (OffShore Energy Biz.). The challenge is therefore not generating new data, but getting our hands on the data we need. If this can be done properly, and quickly, then then it follows that costs will be reduced by drilling less wells. There is then less to discover about a field and our chance of success is much higher.

At Petrosys, our Interica OneView technology does this by scanning across your entire data landscape. We have written connectors, such that, regardless of the application suite, we can extract rich metadata about all known wells (and other subsurface items) and get it in the geoscientist’s hands quickly

2. Finding data is time-consuming – it’s much cheaper to use technology to do it for you

A report by Brule stated that petroleum engineers and geoscientists spend over half of their time searching and assembling data.

In theory, geoscientists could work on twice the number of CCS projects if we could give them a single pane of glass view of all the data available to them instantly. Companies recognise the importance of speed and efficiency to remain competitive – for example, Eni employs their Fast Track approach to the CCS world

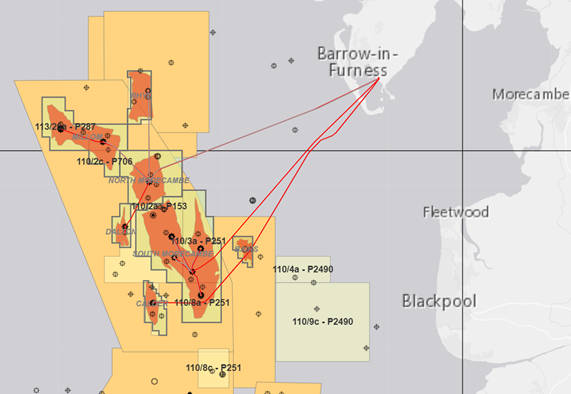

Let’s say I’m a geoscientist who has been asked to evaluate the potential of CCS within the South Morecambe gas field. I can go onto the NSTA Offshore Interactive Maps to find that there are plenty of wells drilled in the area and plenty of seismic. Great! Lots of data to analyse.

But, where do I get my hands on the data?! Is there just 1 copy of each well, or multiple interpretations? Are there duplicate projects? Do I have projects in Petrel? Or are they all in IC? When were the projects last worked on? Who last worked on them?

It’s easy to see how more than half my project is now going to be taken up by searching for available projects, opening them individually, documenting what’s inside of them and creating my own dataset. That’s an expensive use of a highly paid and highly skilled geoscientist’s time

CCS map taken from ArcGIS

Technological innovation and advances mean you don’t have to. Interica OneView (IOV) will already have scanned across all the available application projects by this stage in the workflow. All I would have to do as a geoscientist is bring up the map, draw a box around the area I’m interested in, and IOV will give me all the information I need about the data that’s available to me.

3. Storing live data is expensive – much cheaper to identify data to be archived or deleted

Even now there will be storage facilities with considerable amounts of physical data which only still exists because no one wants to be the person responsible for giving the ok to destroy it. The data has been transformed into digital media, possibly several times over, but it’s human nature to think about the ‘what if’ scenarios, play it safe, and leave it.

Even with reasonably priced storage facilities years of heavy and powerful geoscience application usage can mean disk storage costs mount up significantly. As companies start to move to the Cloud, they are seeing the true cost of storing data with budgets running into $10s of millions of dollars per year.

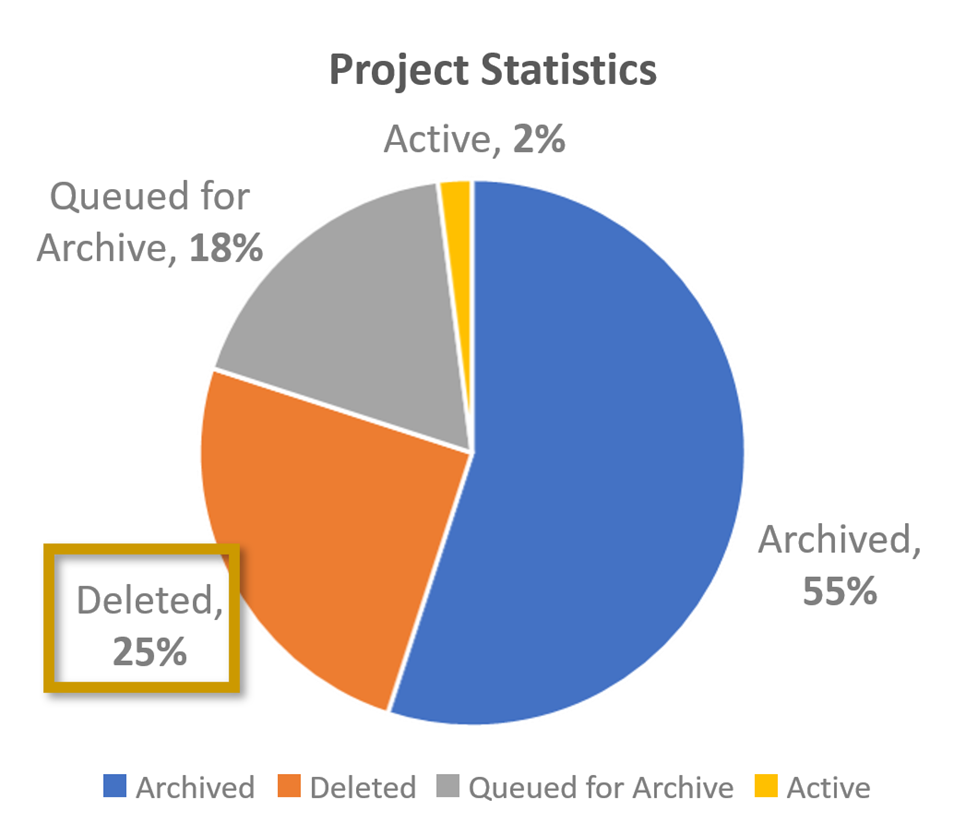

When you consider that in a typical IOV use case, we find 25% of projects are duplicates, there are significant savings to be made very easily.

In addition, there is often significant scope to archive projects to cheaper storage tiers where data is still valuable but hasn’t been used in several years. In the above use case, only 2% of the original data (that’s about 200 projects out of the 10000 at the start) needed to be on the expensive live tier.

Project statistics taken from Interica OneView use case

With the right approach, the sky’s the limit

CCS is an emerging industry and with technology across all sectors advancing at a rapid rate, in my opinion, the commercial viability is just a matter of time. Innovative software solutions, that can streamline data management workflows and provide a clear picture to enable companies to reduce costs are part of that future.

Are there other ways that using data more strategically can improve the commerciality of CCS? I’m sure there probably are and I’d love to hear your thoughts on it.

If you’re involved in CCS projects and you’d like us to take a look at your data landscape then please reach out to me. CCS has a bright future and I’d like to help you get there faster if I can.